portability estate tax definition

The portability law and the IRS have made it very simple when someone passes away they file what is called an estate tax return. However with the passage.

To put it in a nutshell when you died your estate tax exclusion died with you.

. For 2019 the exemption has been adjusted for inflation to 114 million per taxpayer and 228 million per married couple. Thanks to portability the surviving spouse can use the deceased spouses unused estate tax exemption and add it to their own when the surviving spouse passes away. All of these taxes impact the amount of money passed to an individuals.

WHAT IS PORTABILITY AND WHY IS IT IMPORTANT. What Is the Federal Gift and Estate Tax. There are three distinct but related federal transfer taxes.

This is the first time in the history of the estate tax that we have had such a beneficial law. The Tax Cuts and Jobs Act increased the exclusion significantly. That gives the couple a total exemption of more than.

The federal gift and estate tax is essentially a tax on the transfer of wealth. In 2022 you will be taxed if the total of the gross assets at hand exceeds 1206 million. 29 issued Notice 2011-82 to alert executors of 2011 estates of the need to file a Form 706 to make the election to transfer a decedents unused 5 million estate and gift tax exclusion to the surviving spouse.

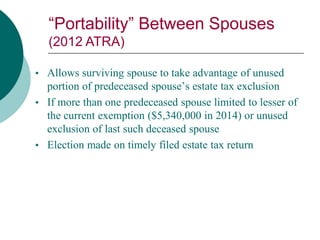

Both transfers made during a taxpayers lifetime in the form of a gift and transfers made at the time of death in the form of an inheritance are subject to the tax. In particular for the executor of a 2011 estate to make a portability ie deceased spouse unused exclusion amount election the executor is. Until 2012 portability was part of a law that had been set to sunset.

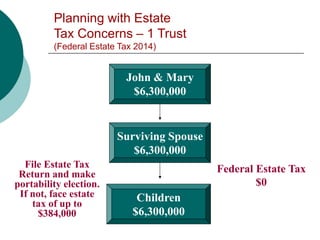

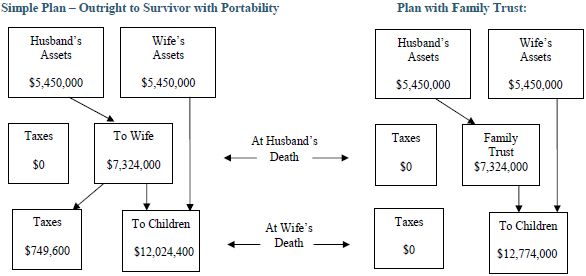

Portability in Estate Tax Exemptions. The surviving spouse can then use his or her own unified credit on additional assets that can pass to children and grandchildren free of gift andor estate tax. In its most basic form portability allows a married couple to claim double the estate tax exemptions.

How does estate tax portability work. The estate tax is a tax on an individuals right to transfer property upon your death. As of January 1 2018 the estate tax exemption for individuals is 1118 million adjusted for inflation.

It is transferred to the surviving spouse to reduce the overall estate tax once the second spouse passes away. Portability has been part of the law since late in 2010. The federal Estate Tax commonly referred to as the death tax is a tax on a persons right to transfer property upon their death.

On top of this generous amount the IRS also allows for portability of the exemption between. Portability and estates Before the new tax laws spouses were not allowed to share their exclusions. Thanks to the portability rule the survivor can use whats left.

The matter of portability in this context refers to the ability of a surviving spouse to use the exclusion that was allotted to his or her deceased spouse. This is called portability. The federal estate tax law was amended in 2013 to permit the executor of the estate of the first deceased spouse to give any unused unified credit to the surviving spouse.

On the new process by being able to do the trusts the way we are doing it nowadays we can now not only avoid the estate tax we can avoid the income tax. Portability allows a surviving spouse to use the unused federal estate tax exemption 549 million in 2017 of the deceased spouse. One of the essential elements in the equation for the computation of both the federal gift and estate tax is the reduction of the tax due by the amount of the estate or gift tax on the applicable exclusion amount also known as the unified credit.

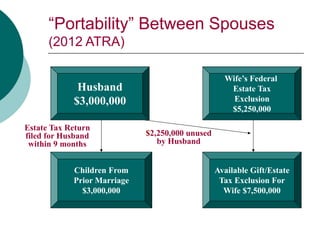

350000 200000 150000 in Tax Benefit. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the unused exemption and add it to the surviving. Portability is a federal exemption.

For a married couple because of the unlimited marital deduction available for property passing between US. Estate and gift taxes are affected by the principles of portability and they are a part of a group of taxes known as federal transfer taxes. Portability is the ability for the surviving spouse to use the deceased spouses unused estate and gift tax exclusion after the deceased spouses death.

The IRS on Sept. Electing to use estate tax portability makes a significant difference in your federal estate tax liability. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home.

Prior to 2011 the estate tax exclusion was not portable. In other words if your assets are worth 1118 million or less at the time of your death and you have not used any of your combined estate and gift tax exemption your estate owes no estate tax. The only way you dont get the portability.

You sell your current Florida Homestead that has an Assessed Value of 200000 and a Just Market Value of 350000. The TCJA doubled the estate and gift tax lifetime exemption from 549 million per taxpayer to 1118 million per taxpayer. Portability is now a permanent feature of the federal transfer tax estate and gift law that allows a surviving spouse to use hisher deceased spouses unused estate tax exclusion up to 543 million in 2015.

On that tax return they have a portability election. The temporary regulations require than an executor include a computation of the DSUE amount on the decedents estate tax return in order to allow portability of that decedents DSUE amount. Portability is the ability to move a certain amount of money that can be left to others tax-free for estate planning purposes as described by WMUR9s article Money Matters.

In other words it could not be relied upon. The answer is that portability allows the first spouse to die to transfer hisher unused estate tax applicable exclusion amount to the surviving spouse who can then use it. Understanding the portability of the estate tax exemption is crucial to ensuring your spouse has a clear understanding of how portability works.

Portability is the term used to describe a relatively new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his or her deceased spouse to shelter assets from gift tax during the surviving spouses life andor estate tax at the surviving spouses death. Estate tax gift tax and generation-skipping transfer GST tax. A surviving spouse can get a big federal estate tax break if the deceased spouse didnt use up his or her individual estate tax exemption.

Historically the estate tax rate fluctuated on a yearly basis. What is estate tax portability.

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Exploring The Estate Tax Part 2 Journal Of Accountancy

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

Estate Tax Introduction Video Taxes Khan Academy

Understanding Qualified Domestic Trusts And Portability

Portability Of Unused Estate And Gift Tax Exclusion Between Spouses

A Guide To Estate Planning Family And Matrimonial United States

Portability How It Works For Estate Tax Batson Nolan

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

Postmortem Tax Planning Ppt Download

Estate Tax Exemption Portability Law Video

An Overview Of Estate Tax Portability Provisions Aicpa Insights

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Deceased Spousal Unused Exclusion Dsue Portability

Credit Shelter Trusts And Portability Eagle Claw Capital Management